fsa health care limit 2021

This dollar limit is indexed for cost-of-living. How much should I put in my FSA 2021.

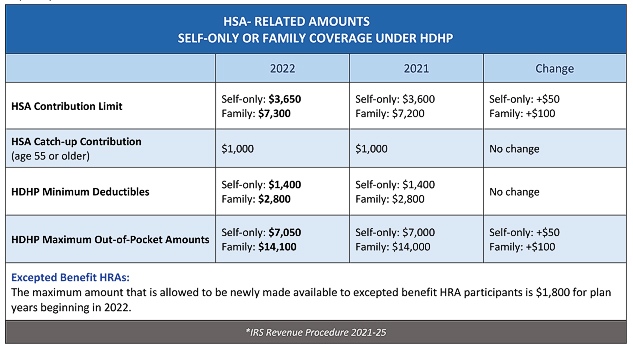

Hsa 2021 Contribution Limit And Hdhp Out Of Pocket To Increase Irs Core Documents

The Affordable Care Act ACA imposes a dollar limit on employees salary reduction contributions to health FSAs.

. The health FSA contribution limit is 2850 for 2022 up from 2750 in the prior year. Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars. What is the 2021 health FSA contribution limit.

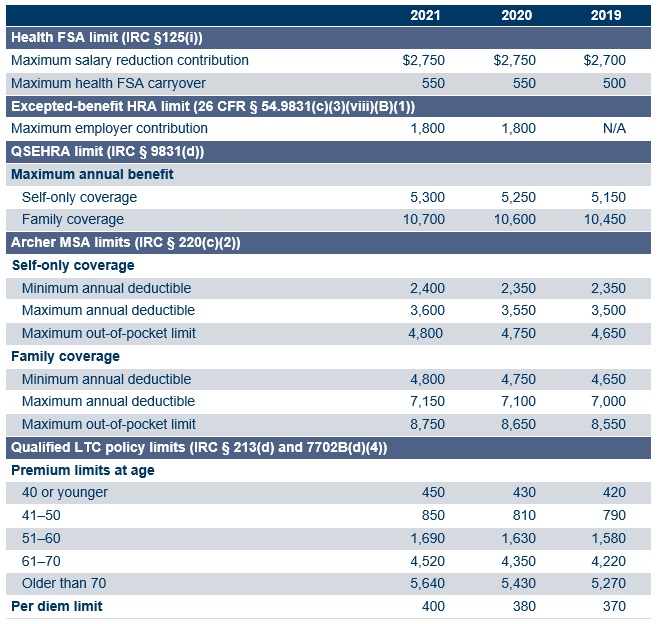

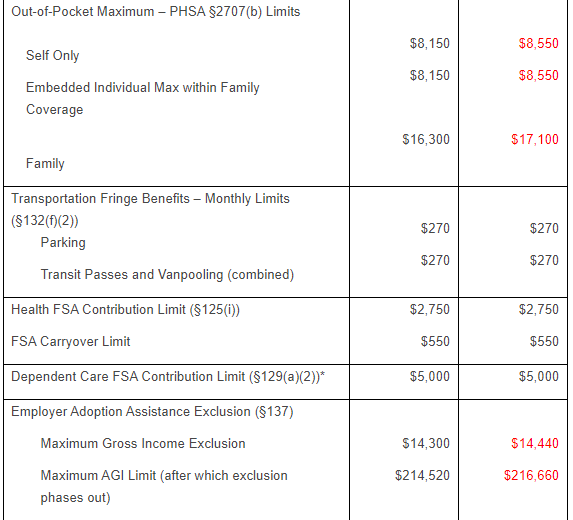

The amount of money employees could carry over to the next calendar year was limited to 550. However carry over amounts have increased from 500 to 550 for any excess balance at the end of 2021 to. However health savings account HSA participants will be able to contribute a little more in 2021.

Health 8 days ago Included in the announcement is the inflation adjusted 2021 limits for Health Care flexible spending accounts. IRS Announces 2021 Health Care FSA Limits Employee. This is a 100 increase from the 2021.

And if an employers plan allows for carrying over. The contribution limit for health FSAs is 3050 for 2023 up from 2850 in 2022. For 2021 the contribution limit is 2750.

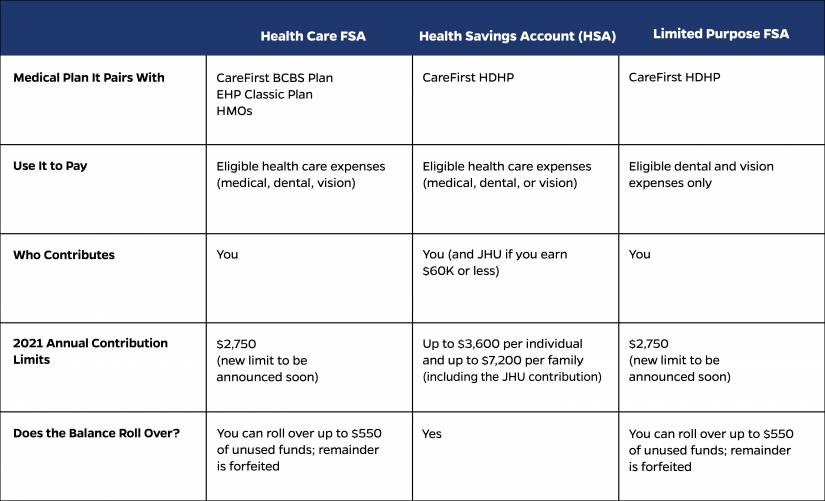

This pre-tax benefit account helps you save on eligible out-of-pocket dental and vision care expenses while taking advantage of the long-term savings power of an HSA. Health Care FSA Limits Increase for 2023. Dependent care FSA limits remain unchanged at 5000.

18 as the annual contribution limit rises to. The IRS announced an increase to the Health FSA contribution limit for 2022 raising your maximum contribution amount to 2850. What is the FSA limit for 2021.

However the Act allows unlimited funds to be. Included in the announcement is the inflation adjusted 2021 limits for Health Care flexible spending accounts FSAs under an IRC 125 cafeteria plan. Note that the limit of 2850 is either for contributions made to an HCFSA or to.

From 2021 to 2022 for. Facts about Flexible Spending Accounts FSA They are limited to 2850 per year per employer. 10 as the annual contribution limit rises to.

If youre married your spouse can put up to 2850 in an FSA with their employer too. For spouses filing jointly each spouse can elect up to the health care max in the year in 2022 that would be 2850 2850 5700 household total. The health FSA contribution.

Plus if you re. The health FSA contribution limit will remain at 2750 for 2021. Employees can put an extra 200 into their health care flexible spending accounts health FSAs next year the IRS announced on Oct.

As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and. No limits to carrying over funds. 2750 Health Care FSA Maximum Plan Limit The pre-tax salary reduction limit for Health Care FSAs will remain at 2750 for plan years on or.

A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere. This 200 increase is higher than previous inflation-adjusted increases. Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov.

The carryover amount of unused health FSA funds is increased to 550 up 50 from the 2020 limit of 500 for 2021. The chart below shows the adjustment in health care FSA contribution limits for plan year 2022. Employees can deposit an incremental 200 into their Health Care FSAs in 2023.

New Flexible Benefits Max Amounts For 2022 Workest

Lower Your Taxes With Spending Accounts Hub

2022 Health Fsa And Other Limits Announced Paylocity

2021 Health Fsa Other Health And Fringe Benefit Limits Now Set Mercer

Irs Lets Employers Give Workers A Break On Fsa Contributions Health Plan Rules

2021 Health And Fringe Benefit Limits Lexology

Health Care Fsa Contribution Limits Change For 2022

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Stimulus Act Raises Dependent Care Fsa Limits Adjusts Tax Credit

Sterling Administration 2022 Hsa And Hdhp Limits Claremont Insurance Services

Plan Limits Employee Benefits Corporation Third Party Benefits Administrator

2021 Health Fsa Limit Will Remain At 2 750

Limited Purpose Fsa Lpfsa Optum Financial

California Mandates On The Flexible Spending Account Fsa Kbi Benefits