child tax credit september 2020

The Child Tax Credit begins to be reduced to 2000 per child if your modified AGI in 2021 exceeds. The 2020 Child Tax Credit is intended to help offset the tremendous costs of raising a child or children.

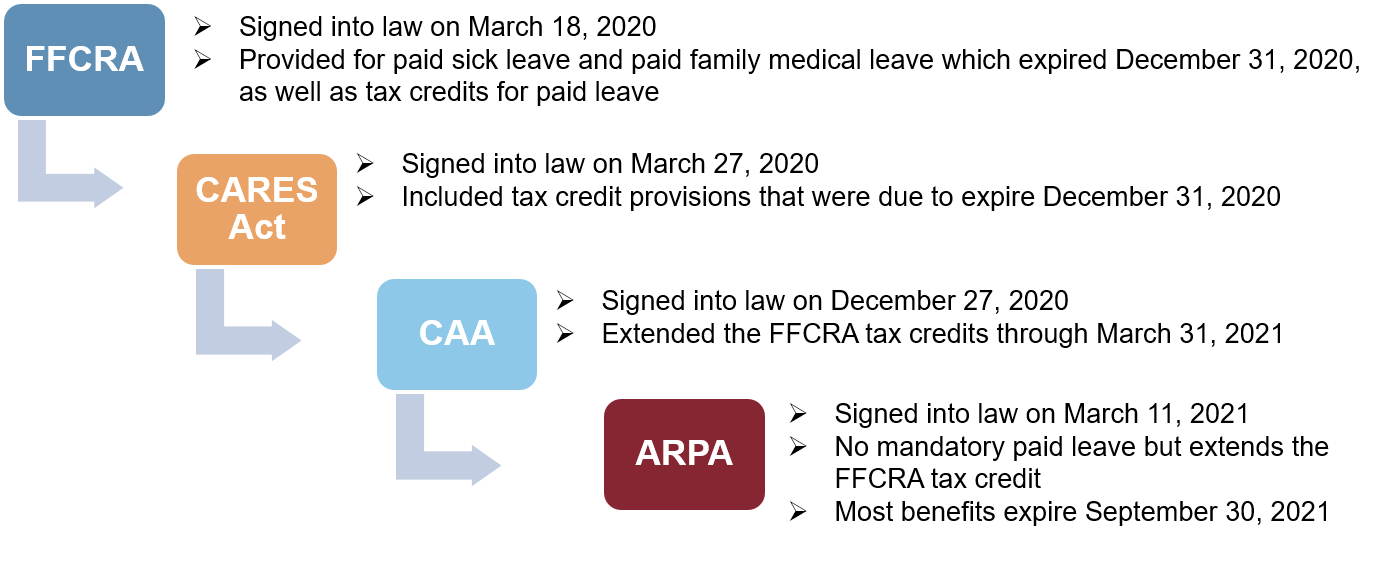

Key Takeaways For Employers The Arpa S Expanded Sick Family Medical Leave And Cobra Benefits Eckert Seamans

By claiming the Child Tax Credit CTC you can reduce the amount of money you owe on your federal taxes.

. It is a partially refundable tax credit if you had earned income of at. More than 48 million households were projected to claim the Child Tax Credit for 2020 according to the congressional Joint Committee on Taxation. This will amount to 1175.

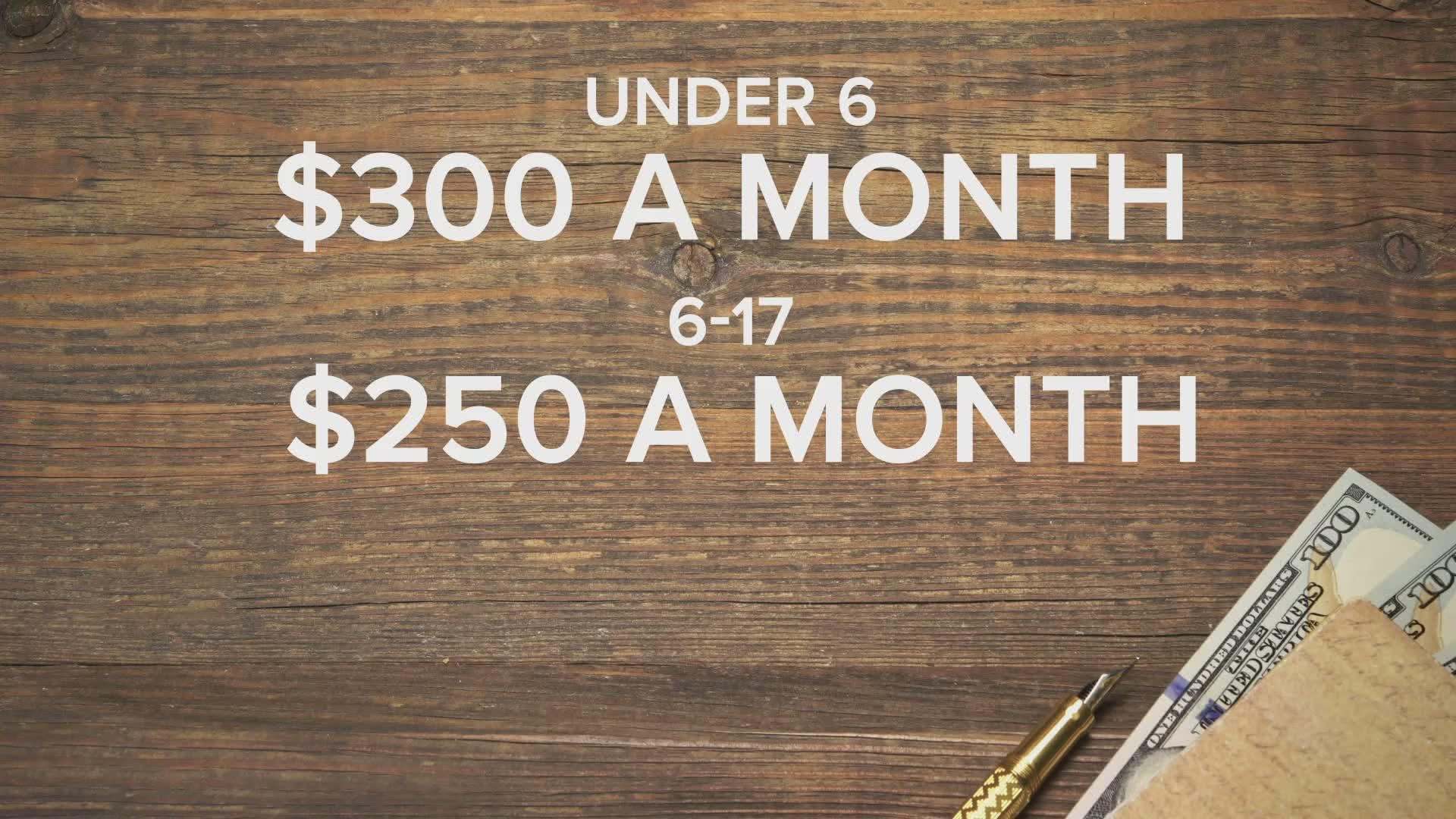

Taxpayers may be able to claim the child tax credit if they have a qualifying child under the age of 17. The other 1800 will be eligible to be claimed next year during tax time. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from.

The amount of credit you receive is based on your income and the. 6 min read. Total child tax credit payments between 2021 and 2022 could be up to 3600 per kid.

The updated Child Tax Credit is based on parents modified adjusted gross income AGI as reflected on their 2020 tax filing. IRS Tax Tip 2020-28 March 2 2020. The IRS is paying 3600 total per child to parents of children up to five years of age.

150000 if married and filing a joint return or if filing as a qualifying widow or. September 17 2021 This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15 billion. The Child Tax Credit will help all families succeed.

The credit amount was increased for 2021. Through the 2021 Enhanced Child Tax Credit families were able to receive 3600 for children under 6 years of age and up to 3000 for children between ages 6 to 17. Specifically the Child Tax Credit was revised in the following ways for 2021.

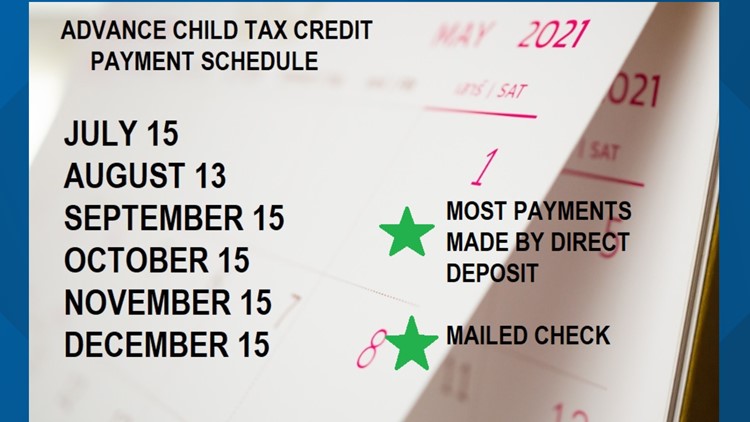

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. Child Tax Credit Information from WhiteHousegov Starting July 15 and continuing through December 2021 the new federal Child Tax Credit in the American Rescue Plan Act provides. Millions of families across the US will be receiving their third.

The American Rescue Plan increased the amount of the Child Tax. AGI is the sum of ones wages interest dividends. List of payment dates for Canada Child Tax Benefit CCTB GSTHST credit Universal Child Care Benefit UCCB and Working Income Tax Benefit WITB.

Part of this credit can be refundable. Over 90 of American families with children are eligible to receive this credit this year regardless of how. That drops to 3000 for each child ages six through 17.

Half of the total is being paid as. In 2020 the two child poverty measures began to diverge due to the impact of large anti-poverty programs established or expanded in response to the COVID-19 pandemic. IR-2021-188 September 15 2021 WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now.

IR-2021-153 July 15 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving.

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

New Child Tax Credit Explained When Will Monthly Payments Start 9news Com

Child Tax Credit Payment Schedule Here S When To Expect Checks 10tv Com

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

What You Need To Know About The Child Tax Credit The New York Times

Child Tax Credit 2021 How To Track September Next Payment Marca

Irsnews On Twitter Not Sure If You Qualify For Advance Childtaxcredit Payments Check Your Eligibility By Using Our Advance Child Tax Credit Eligibility Assistant Learn More From Irs At Https T Co 9j5hb58rqx Irstaxtip Https T Co Xrcajljyfx

Deadline To Opt Out Of September Child Tax Credit Payment Is Monday Here S How To Cancel It Fingerlakes1 Com

What To Know About September Child Tax Credit Payments Forbes Advisor

The New Child Tax Credit Does More Than Just Cut Poverty

Understanding Economic Impact Payments And The Child Tax Credit National Alliance To End Homelessness

The American Families Plan Too Many Tax Credits For Children

Child Tax Credits Are Expected To Start Arriving In July Here S What To Know Bridge Michigan

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

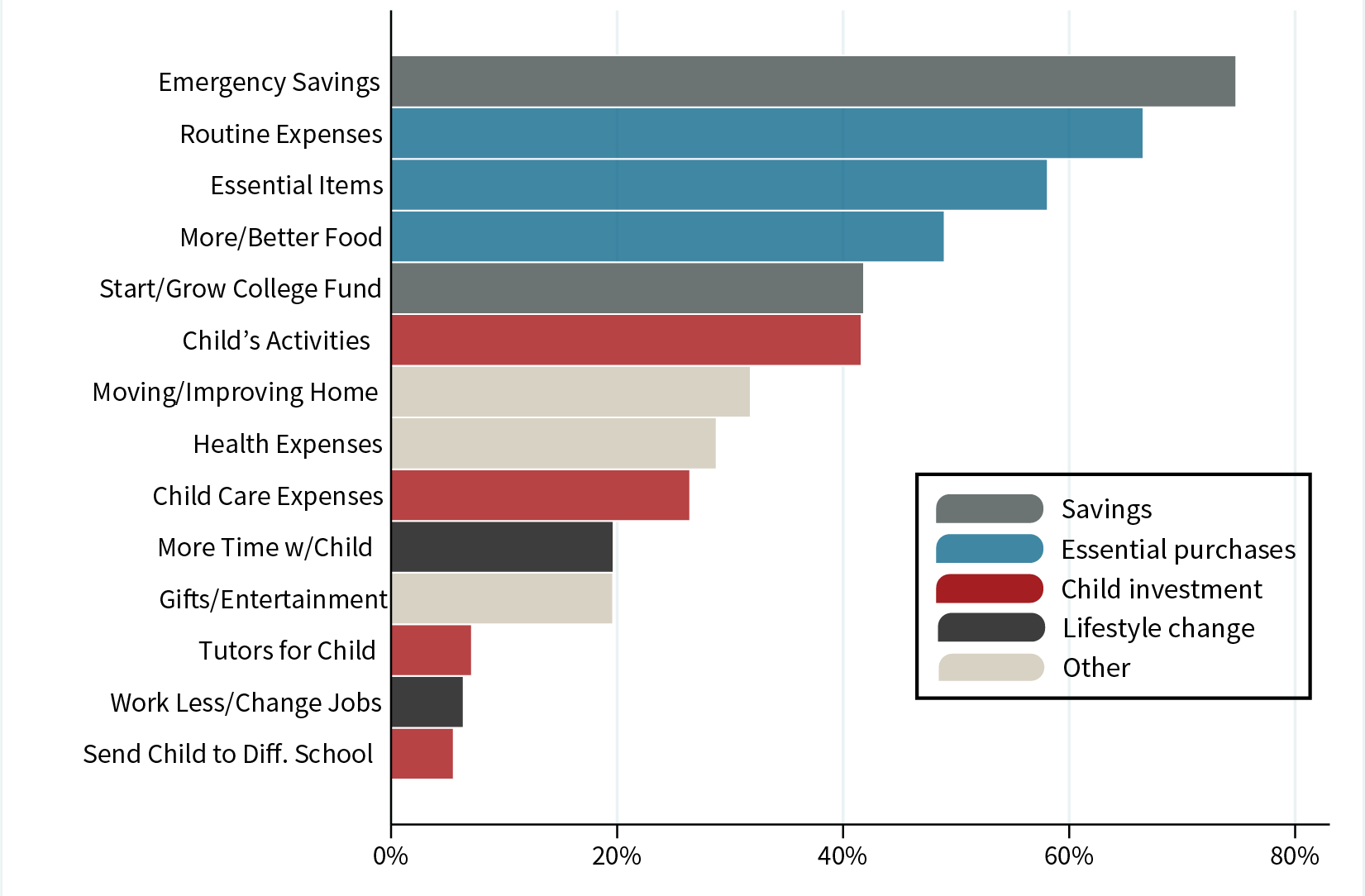

The Child Tax Credit Is Keeping Families Afloat About Saverlife

Irs Child Tax Credit 2021 Update Advance Payment Date For November Revealed And Opt Out Deadline You Must Act Before The Us Sun

Revised Child Tax Credit Everything You Need To Know Ramseysolutions Com

Should You Opt Out Of The New Advance Child Tax Credit Payments Here S What You Need To Know Allmomdoes

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx