ayurvedic hair oil gst rate

Girnar Ayurvedic Pharmacy Pvt. Yes GST is applicable on exports in India and is 5 12 18 and 28 depending upon HS Code of Herbal Hair Oil.

Gst Rate For Perfume Cosmetics And Toiletries Indiafilings

Know what else have been changed.

. Haldi Powder Moringa Oleifera Leaf Moringa Leaf Extract Herbal Tea Dietary SupplementAyurvedic Medicine Amla Powder Ginger Extract Ashwagandha Herbal Extract Cordyceps Militaris. Classification of goods - rate of GST - Himsa Plus Oil which is a ayurvedic hair oil used for various hair disease and headache - beauty product or medicinal products - The product Himsa Plus Oil is poured on hair for beautification or promoting attractiveness as the same is in the nature of cosmetics. While others say that increased GST rates will increase EMIs.

Hair cream Hair dyes natural herbal or synthetic other than Hair oil other than 33059011 33059019 except Mehendi pate in Cones 3305. Yes GSTIN and IEC documents are required for exporting Herbal Hair Oil products. We believe this will have an adverse effect on the category and that too at a time the government has been talking about promoting traditional Indian alternative medicine Malik had said.

- Schedule II- 6 Schedule IV - 14 Schedule III - 9 Schedule III - 9. DIGITAL DUPLICATOR Products Include. Home Shop Products tagged hair oil hsn code and gst rate Default sorting Sort by popularity Sort by average rating Sort by latest Sort by price.

Low to high Sort by price. This is prepared using 4 different types of oil like coconut oil castor oil badam oil amlas oil. According to the opinion of lots of people the effective loan amount will increase due to higher GST rates by 3 over Service Tax rates.

Gst Rates Here S Your Complete Guide Discountwalas. GST Classification of Ayurvedic Beauty and Make-up Preparations. GST rate for classical or generic range of ayurvedic medicines must be nil and 5 per cent for patented products instead of the proposed 12 per cent the Association of Manufacturers of Ayurvedic Medicines AMAM has said.

To determine the rate of tax on the products in question we need to examine the relevant competing entries concerning the product in question. GST Rates HSN Codes for Cosmetics Essential Oils Perfumery - Essential oils terpeneless or not. Started its operation in the year 1996 and is engaged in manufacturing and trading a wide range of the finest quality of Ayurvedic Hair Oil Ayurvedic Soap Ayurvedic Rose Water Ayurvedic Winter Cream Ayurvedic Body Lotion Ayurvedic Petroleum Jelly Ayurvedic Pain Balm Ayurvedic Pain BalmThe product range offered by us.

Yes GST is applicable on exports in India and is 5 12 18 and 28 depending upon HS Code of Herbal Hair Oil. At present the ayurvedic medicines and products have a total tax incidence of 7 per cent including VAT depending on the items. Medicaments excluding goods ofheading 3002 3005 or 3006 consisting of mixed or unmixed products for therapeutic or prophylactic uses put up in measured doses including those in the form of transdermal administration systems or in forms or packings for retail sale.

HS Code Description GST 12119029. Manufacturer of Ayurvedic Hair Oil - Girnar Ritha Herbal Hair Oil. GST Rate Schedule for Goods.

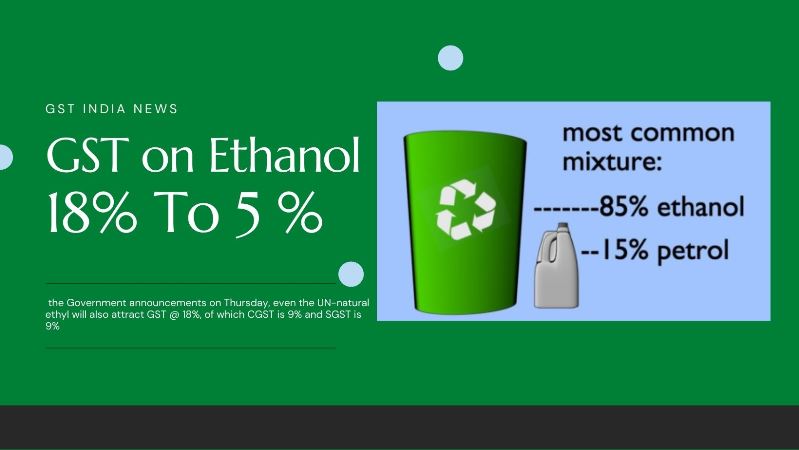

Which Emami positions as an Ayurvedic hair oil has a 34 per cent share of the Rs 720 crore segment. Manufacturer of Ayurvedic Hair Oil - Hair Growth Oil offered by TCN Enterprises Delhi. GST on Ayurvedic products revised from 12 to 5.

Home Our Products Ayurvedic Hair Oil. Harmonized System of Nomenclature HSN is an internationally recognized productitems coding system which is also has been accepted in India. GST HS Code and rates for ayurvedic-hair-oil Serach GST hs code and tax rate Showing Result for ayurvedic-hair-oil Find GST HSN Codes with Tax Rates Here you can search HS Code of all products we have curated list of available HS code with GST website.

High to low Onion Oil. 08046031347 71 Response Rate. G I D C Rajkot Gujarat.

Ms Wire Products Include. Edible mixtures or preparations of animal fats or animal oils or of fractions of different animal fats or animal oils of this Chapter other than edible fats or oils or their fractions of heading 1516. GST rate for classical or generic range of ayurvedic medicines must be nil and 5 per cent for patented products instead of the proposed 12 per cent the Association of.

GST Rate Schedule for Goods. 30049011 Medicaments excluding goods of heading 3002 3005 or 3006 consisting of mixed or unmixed products for therapeutic or prophylactic uses put up in measured doses including those in the form of transdermal administration systems or in forms or packings for retail sale other. The procedure to find HS Code with tax rate is very simple.

It contains almost 5000 commodity groups which is being identified by a six digit code. 500 hair oil soaps toothpaste and shampoos chemical and. Each group is assigned in a most scientific way along with product description for uniform classification.

GST Rate in India. Ayurvedic unani homoeopathic siddha or bio- chemic systems medicaments put up for retail. Adivasi Ayurvedic Hair Oil is presented by Adivasi Shivashakthi Herbal Enterprises.

Know what else have been changed. Tomato sauce mustard sauce and fruit preserves Ayurvedic and homeopathy medicines Processed foods Fruit juices live animals meats butter cheese Mobile phones Ready-made garments. Air Blower Products Include.

Is GST required for export. Call 08048743634 88 Response Rate. It contains 101 types of pure ayurvedic herbs and roots for example Bhringaraj Brahmi Amla Aloe vera Hibiscus flower etc.

The rate of Service Tax was 15 which has now increased to 18 for GST. Dabur India CFO Lalit Malik had said on Friday that the company was disappointed with the governments decision to levy 12 GST on ayurvedic products. 15171010 15171021 15171022 15171029 15179010 15179020 15179030 15179040 15179090.

Here are the tax rates for. The relevant entries are reproduced hereunder. Herbal Tea Organic Moringa Leaf Powder Dried Moringa Leaf Moringa Oleifera Moringa Tablets Jaifal Lemongrass Moringa Leaf Powder.

17 rows GST Rates HSN Codes for Cosmetics Essential Oils Perfumery - Essential oils terpeneless or. Preparations for use on the hair. 33051010 33051090 33052000 33053000 33059020 33059030 33059040 33059050.

Gst Rates In India Gst Rate Finder Item Wise Gst Rate List In Pdf

Gst Rate In India A Complete List Of Essential Commodities

Iiem Indian Institute Of Export Management Gst Rates Schedule For Goods Announced On 18 05 2017 Following List Shows Rates For Salient Items For Entire List Of Items Visit Http Iiem Com News Resources Comment Below If

Gst Rate Changes For The Year 2020 2021 Vakilsearch

Gst Rates Know Gst Rates In India Tax Exempt Items Slabs More

Gst Rate Structure India 2020 Gst Rates Item Wise List Pdf Exam Updates

Rate Of Gst For Perfumes Cosmetics Essential Oil Toilet Preparations

![]()

All Gst Hsn Code And Rates In Excel

Gst Rates Here S Your Complete Guide Discountwalas

Gst Tax Rate What Are Rate Of Taxes Under Gst Taxmann Blog

Overall Structure Of Goods And Services Tax In A Nutshell

What Are The Currently Effective Gst Rates In India Enterslice

Hsn Code Gst Rate For Cosmetics Essential Oils Perfumery Chapter 33 Tax2win

Gst Rate In India A Complete List Of Essential Commodities

Gst Rates For Goods And Services With Hsn Company Suggestion

Complete List Of Gst Rates Of India Bankexamstoday

Gst Rates Here S Your Complete Guide Discountwalas

Gst On Ayurvedic Products Revised From 12 To 5 Know What Else Have Been Changed